Kabusshiki Kaisha = KK (type of business entity)

投稿日:

■Outline and establishment

Kabushiki Kaisha (=KK) is the most common and polular corporate form in Japan than other corporate forms. KK is a limited stock corporation, meaning its shareholders are protected from liability claims made by third parties (up to their capital contribution). The minimum capital requirement is JPY 1.

KK must be registered in Japan. KK requires at least one individual as a director and one individual or corporate as a shareholder. They are not required to be JP resident.There is no company secretary system in Japan. Also no need of address certification for company head office.

It typically takes about four weeks to set up KK.

es Act in Japan outlines the requirements for establishing a KK, which has created a number of categories of KK, based on whether it is large or small, open or closed, listed or non-listed. The corporate governance and management structure for KKs will vary depending on whether or not the KK is open or closed, and large or small.

All KKs need at least one director. In cases where three or more directors are appointed, a board of directors and a statutory auditor need to be appointed.

■Corporate Govenance

Shareholder nominate at least one director. The direcotor become Representative of director if KK has one director. If KK has two or more directors, the directors (or shareholder) must assign one Representative of directors. In cases where three or more directors are appointed, a board of directors and a statutory auditor need to be appointed.

Compare to the branch manager of the Branch Office, Representative of director of KK has extremely strong power for company’s business activity. Since the Representaive of director is representing KK, the business contract is made under the name of Representative director. Non-Representative directors can not represent KK in this meaning.

Representative director has strong power for corporate business activity compare to the branch manager of the Branch office. KK is better if you want to delegate Japan business

■Taxation

(General)

KK is subject to corporate tax in Japan. Taxation is as almost same as Branch and GK.

(PE issue)

In principle, KK is not PE (=Permanent Establishment) of shareholder company. If the shareholder company already sales to the customers in Japan, KK is the best form to avoid PE taxation.

関連記事

-

-

8/31(月)から東京事務所が移転します

アルテスタ税理士法人 東京事務所 〒105-0003 東京都港区西新橋1-20- …

-

-

居住者か非居住者か?② 税務調査

2017年1月23日の国税不服審判所(←国税庁が設けた裁判所のようなものです)の …

-

-

退職金の収入すべき時期 (水曜勉強会)

今日の講師は山本さんです。 退職手当金の収入時期に関する裁判事例を解説してもらい …

-

-

Cees宅にお邪魔しました

オランダ人弁護士のCeesが、イタリアに保有する別荘に4家族でお邪魔してきました …

-

-

20ヵ国でのWeb会議

ZOOMで20ヵ国ほどのアジア/アフリカ/オーストラリア地域の会計事務所があつま …

-

-

取締役会を一切開催しないことは可能か?

【Q】当社は取締役会設置会社ですが、社外取締役、社内取締役が、国内外に分散してい …

-

-

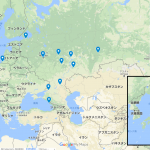

サッカー ロシアワールドカップ 開催都市は?

サッカーワールドカップの組合抽選が間もなくです。開催都市は下記11都市です。日本 …

-

-

税制適格ストックオプション(水曜勉強会)

今日の勉強会の講師は山本さんでした。今回は税制適格ストックオプションの要件につい …